Tools Retail Trends: Shifting Dynamics and Emerging Players

As noted in YipitData’s 1H23 State of the Home Improvement Report, the tools industry has undergone subtle but notable shifts in consumer spending preferences post-pandemic, giving rise to interesting trends within hand tools, power tools, and power tool accessories.

1. Hand tools are rising in popularity amidst a changing landscape

Over the past few years, hand tools have gained significant traction among consumers, emerging as the top tool subcategory with a commanding 29% share. Despite a slight dip during 2020-2021, hand tools have bounced back and maintained their lead.

Category Share of Tools Sales Home Improvement Industry

United States | Online + Offline Sales | H1 2019 - 2023

Interestingly, power tools declined in category share from 2022 to 2023, while power tool accessories rose in popularity. This highlights a nuanced consumer preference for accessories that enhance the functionality and performance of existing tools.

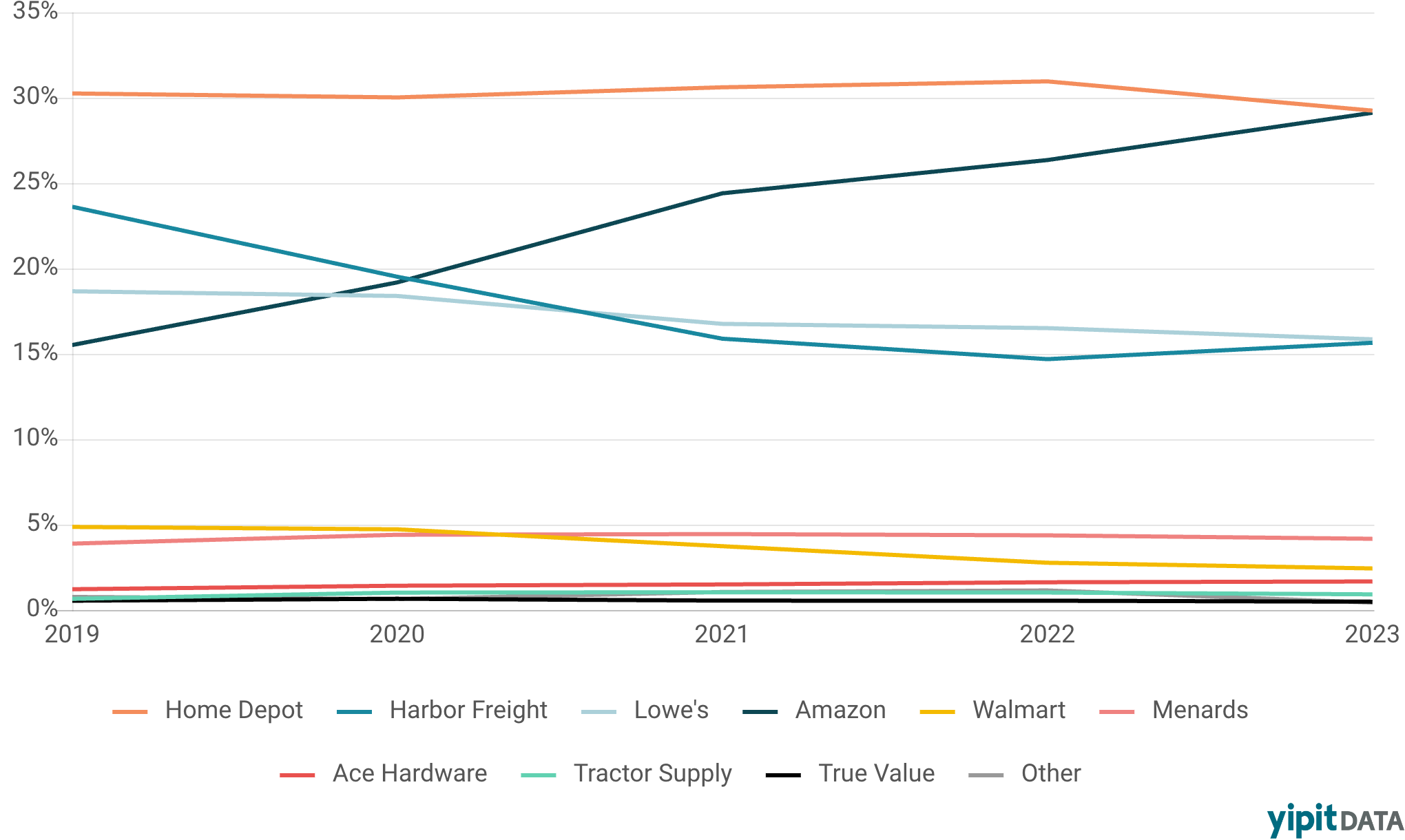

2. Home Depot and Amazon battle for hand tools dominance

The competitive hand tools landscape is witnessing an intense rivalry between industry giants. While Home Depot has remained the category leader for five consecutive years, Amazon has been steadily closing the gap, now trailing Home Depot by just 0.1 pp (as of 1H23). Amazon's impressive growth, from 26% to 29% in just one year, showcases the online retailer's ability to adapt to evolving consumer demands and preferences.

Retailer GMV Share of Hand Tools Market

United States | Online + Offline Sales | H1 2019 - 2023

This shift in market dynamics has placed strain on Home Depot, with the company losing 2 pp in market share from 2022 to 2023.

3. Brand Preferences in the Hand Tools Segment

Zooming in on hand tools at Home Depot, it's clear that brand preferences are evolving as well. Husky currently leads the pack with around 20% brand share. However, Milwaukee has experienced remarkable growth, nearly doubling its brand share from 7% in 2019 to an impressive 13% in 2023. In contrast, brands like 3M and Dewalt have witnessed a decline in their share of hand tool sales at Home Depot over the past five years.

Brand Share of Hand Tools at Home Depot

United States | Online + Offline Sales | H1 2019 - 2023

Interested in unpacking your tools subcategory performance at the retailers you care about?

Retailers include: Home Depot, Lowe’s, Amazon (Omni-Channel)

Sources: Email Receipt Data, Physical Receipt Data

Want to stay up to date on the latest trends in home improvement? Subscribe to our blog.