YipitData OER Index - December Update

Housing is consistently the heaviest-weighted component of the CPI framework, making comprehending its impact paramount.

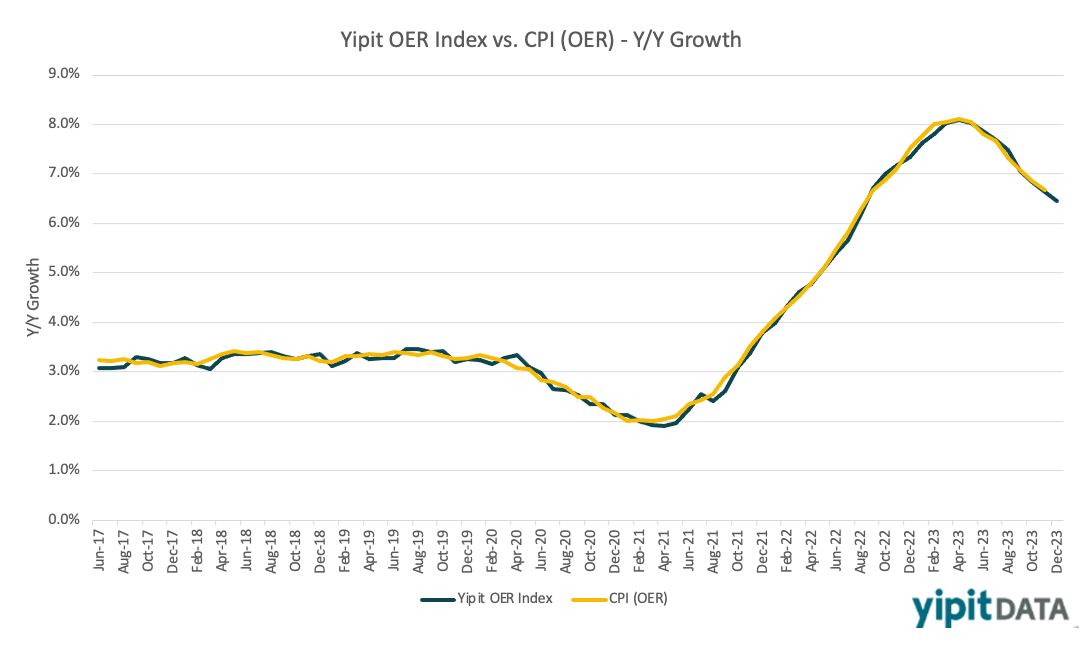

Using one of our 40 datasets, we’ve created an index to track owner’s equivalent rent (OER), one of the key reasons why core-CPI continues to surpass the Fed's 2% target. This Index provides foresight into the future landscape of housing and the ever-changing world of CPI.

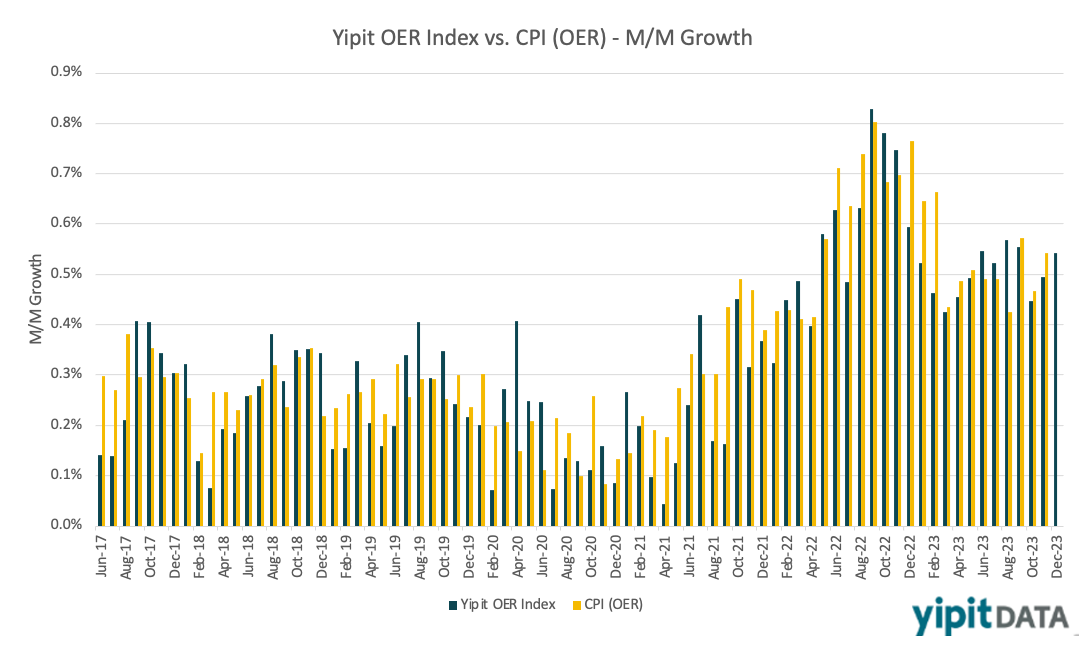

Our model based on thousands of single and multi-family rental payments from our proprietary email receipt panel suggests OER for December CPI will grow +6.4% Y/Y and +0.5% M/M (non-seasonally adjusted). The Yipit OER index projects the Y/Y slowdown to extend through February 2024 but is expecting a consistent M/M growth of +0.5% or an annualized +6.2% during this period.

Interested to know what the YipitData OER Index projects through February 2024? Contact us to learn more.

Want to track inflation in real time? Contact us and a member of our team will be in touch.